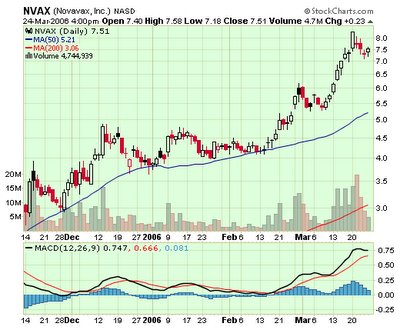

NVAX and $NNZ

Four months ago I was tracking the heaviest stock on the Merrill Lynch Nanotech index, NVAX (Nanovax), and mentioned in the end of November that the 50 day moving average was being used as a good support and the stock looked nice for an entry point at the 3 dollar per share value.

Now we can see how the 50 day moving average did indeed hold the price of this stock with more than 150% gains in the last 4 months:

Remember that nanotechnology is for the longterm and some of this stocks are good for the next couple of years, even if some of them can't get that far.

While I believe in protective stops to avoid future Bear rallies or Bear markets, it's best not to use stop gains since much of the profit comes from these mid/long term moves.

The $NNZ is in new highs and if the S&P500 and NASDAQ go up this week we might finally have a breakout confirmation:

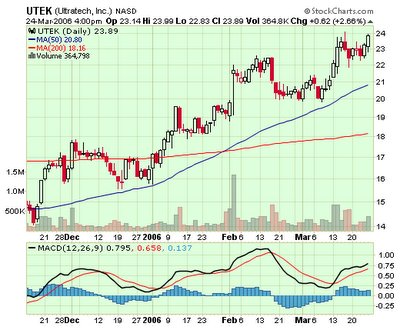

And some other good looking nanotech index stocks charts:

5 Comments:

Hi,

Do you have any idea whether specific SEC rules applies to these companies? I am curious on how the environmental impact assessment is made. Thanks

Hi,

Do you have any idea whether specific SEC rules applies to these companies? I am curious on how the environmental impact assessment is made. Thanks

Well done!

[url=http://uhpdwafo.com/aqij/etvl.html]My homepage[/url] | [url=http://phheopkt.com/lrsu/hcap.html]Cool site[/url]

Thank you!

My homepage | Please visit

Nice site!

http://uhpdwafo.com/aqij/etvl.html | http://ihultsmh.com/oqcw/vovv.html

Post a Comment

<< Home