Back into black?

After last week's update where are we now?

The 200 point area in the Nanotech index seemed to be a good reentry point, after the selloff in the global markets, leaving many new opportunities for the long term investors.

The prices are bouncing off their recent lows but the question remains. Whether we are in a short term corretion or a longer term downward move is yet to be answered:

And now for some nanotechnology news:

Bear Stearns seems to be having the same opinion many "nanotechnology informed" investors have regarding the future of nanotech stocks.

Maybe the next big bubble will not be China nor Web 2.0

Bear Stearns Says NanoBubble Yet to be Blown

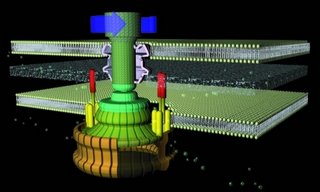

Finally someone trying to replicate biology while construction a nanomotor instead of using nano-scale replicas of factory production lines that probably will never work:

EU supports research towards the construction of nanomotors

Interesting read about the near-future of Artificial intelligence.

But maybe let's first define and understand what "intelligence" means in order to make an artificial form of it.

Is AI Near a Takeoff Point?

There is a new Nanotech Blog at Nanotech Briefs:

Nano Test blog